Rural and Urban Consumption Patterns in FMCG 2024-25

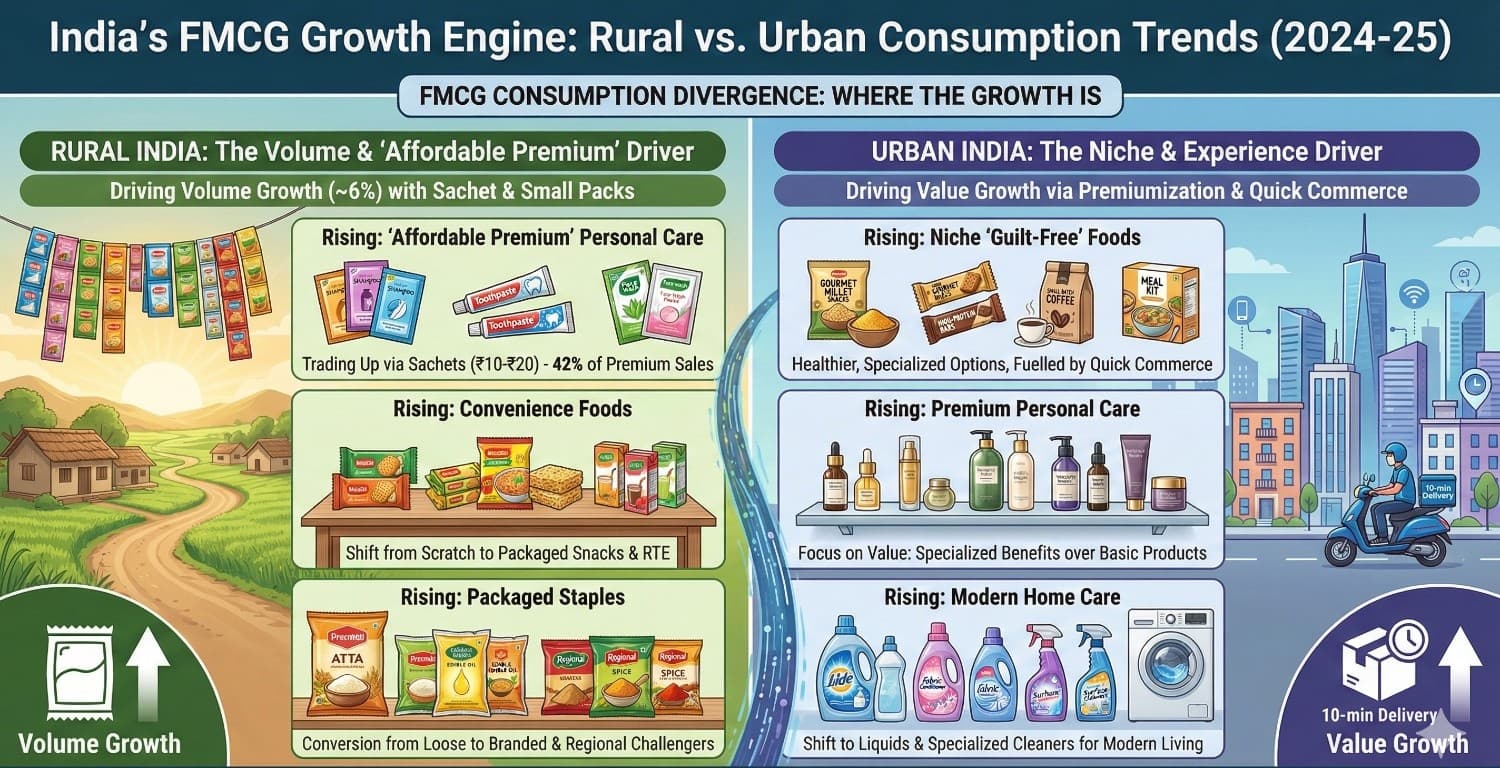

In 2024 and leading into 2025, a distinct divergence has emerged in Indian FMCG consumption: Rural India is driving volume growth (purchasing more units), while Urban India is driving value through premiumization and shifting spending toward non-FMCG lifestyle goods.

For the first time in several quarters, rural volume growth (~6%) has outpaced urban growth (~3%), signaling a "rural revival" driven by better monsoons and "affordable premium" options.

The following breakdown identifies the rising categories in each market:

1. Rural India: The Volume & "Affordable Premium" Driver

Rural consumers are upgrading their lifestyle, moving from unbranded/loose products to branded packaged goods, and surprisingly, driving the growth of premium segments via small packs (sachets).

2. Urban India: The Niche & Experience Driver

Urban demand for mass-market goods has softened due to food inflation and a shift in wallet share toward electronics and durables. However, growth is strong in specific high-value niches.

Summary of Key Differences:

Insight:

Insight:

The "Rural Premium" story is currently the most dynamic, as village consumers trade up to brands like Dove or Tata Tea Premium via small packs. In contrast, Urban growth is defensive, relying on convincing existing users to pay more for specialized benefits (health, beauty, convenience).

Data Source Attribution:

The insights in the infographic are a synthesis of market intelligence reports released in Q3 and Q4 of 2024-25 from the following primary sources:

1. NielsenIQ (NIQ) - Quarterly FMCG Snapshots (Q3 2024 - Q2 2025)

Advertisement

Key Metric Cited: The volume growth divergence. NIQ reported that rural volume growth (~6.0%) was growing nearly 2x faster than urban volume growth (~2.8%) in recent quarters (specifically cited in their Q3 2024 and mid-2025 updates).

Trend Validation: The "Rural Revival" narrative is based on NIQ data showing rural markets outpacing urban markets for 6–7 consecutive quarters as of mid-2025.

2. Kantar Worldpanel - "FMCG Pulse" & "Rural Barometer" Reports

Key Metric Cited: The "Affordable Premium" shift. Kantar data highlights that rural India now accounts for approximately 42% of premium FMCG sales, driven by small packs and sachets.

Category Insight: The insight on "Bridge Packs" (upgrading from ₹5 to ₹10/₹20) and the specific rise in personal care categories (Face wash, specialized hair care) comes from Kantar’s household consumption analysis.

3. Industry & Corporate Filings (Corroborating Sources)

Companies: Quarterly earnings commentary (FY25) from HUL (Hindustan Unilever), Dabur, and Nestle India.

Example: HUL and Dabur management have explicitly noted "rural volume recovery" vs. "urban value growth" in their earnings calls.

Example: Nestle India reports substantiate the "urban niche food" trend (e.g., high growth in premium coffee and specialized nutrition).